Property Cash Out In Malaysia

Property Cash Out is a financing strategy in Malaysia that allows buyers to purchase a property and receive extra cash from the loan.

With low interest rates, high approval chances, and flexible financing, it has become a popular way for borrowers to unlock cash while owning a property.

- RM50K - RM100K Cash out

What Is Property Cash Out?

In Malaysia, many buyers today apply for a housing or commercial property loan not because they want the property, but because they want the loan’s cash-out benefits.

Why?

Because property loans are the cheapest, easiest and safest financing method compared to personal loans, koperasi loans, business loans, or refinance options.

Through Property Cash Out, borrowers can:

Buy a property and at the same time receive extra cash from the loan,

Avoid paying upfront costs like legal fees, valuation fees, down payment,

And enjoy low monthly instalments with a secured asset.

One of our unit for sale: Personal loan vs Property Cash Out.

Use property cash out for loan instead property

1. Housing Loans Have the Lowest Interest Rate

Mortgage rates in Malaysia remain low and stable, making monthly repayments very affordable.

Compared to:

Koperasi: high interest

Personal loan: high interest & short tenure

Business loan: strict approval

Credit cards: extremely high interest

Housing loans clearly offer the cheapest financing cost.

1. Housing Loans Have the Lowest Interest Rate

Mortgage rates in Malaysia remain low and stable, making monthly repayments very affordable.

Compared to:

Koperasi: high interest

Personal loan: high interest & short tenure

Business loan: strict approval

Credit cards: extremely high interest

Housing loans clearly offer the cheapest financing cost.

2. Approval Rate Is Higher Because It Is a Secured Loan

Banks love property loans because the property acts as collateral.

If the borrower fails to repay:

Bank can auction (lelong) the property

Bank can recover their money

This makes banks more comfortable to approve mortgages compared to personal loans or business loans.

Higher approval = easier cash-out.

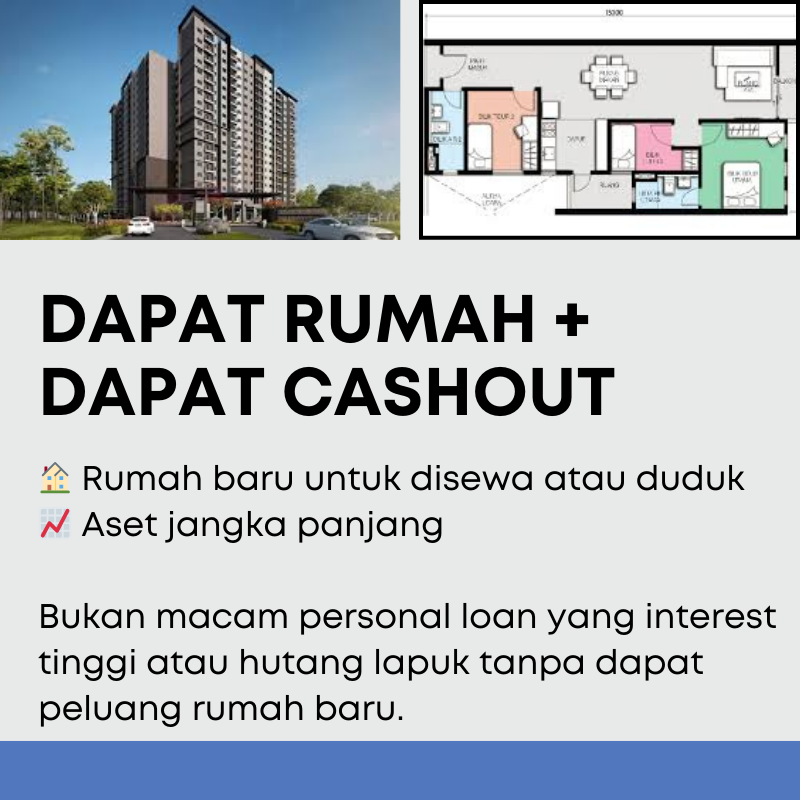

3. Borrowers Receive a Property That Rarely Depreciates

Even if the borrower does not want to stay in the property:

They can rent it out

They can sell it later

Property value is more stable than cars or other assets

This means they get cash today from the loan AND still own an asset that grows in value.

4. Better Than Refinance, Koperasi, or Personal Loan

Refinancing used to be the best option.

But now:

Bank Negara Malaysia has restricted many refinance packages to max 10-year tenure.

This makes:

monthly repayments very high

borrowers unable to qualify for larger amounts

Therefore, many Malaysians now use Property Cash Out via a new purchase because they can enjoy:

35-year tenure

low instalment

better cash flow

larger approved loan amount

This is why they prefer buying a property for cash-out instead of refinancing the existing one.

So What Exactly Is the Property Cash Out Strategy?

Here’s the truth about how Malaysians do it:

They identify a suitable residential or commercial unit.

The bank values the property at a certain amount.

Loan margin + valuation creates extra financing room.

All costs (legal, stamp duty, valuation) are included into the loan.

Whatever balance remains becomes buyer’s cash-out.

This means:

✔ The borrower gets cash

✔ The borrower gets the property

✔ The monthly repayment stays low

✔ Total approval is easier due to secured loan

Why Use Citiharta Tanah Consultancy for Property Cash Out?

We help clients:

✔ Choose suitable properties that allow higher cash-out potential

✔ Match with banks that offer the best financing structure

✔ Handle lawyer, banker, valuation coordination

✔ Ensure compliance with bank procedures

✔ Maximise client’s cash-out safely and professionally

Get Started Today!

Let’s discuss your financial plan today!

Call us at 0174088677 or WhatsApp us now to learn more!